Division a Has Variable Manufacturing Costs of

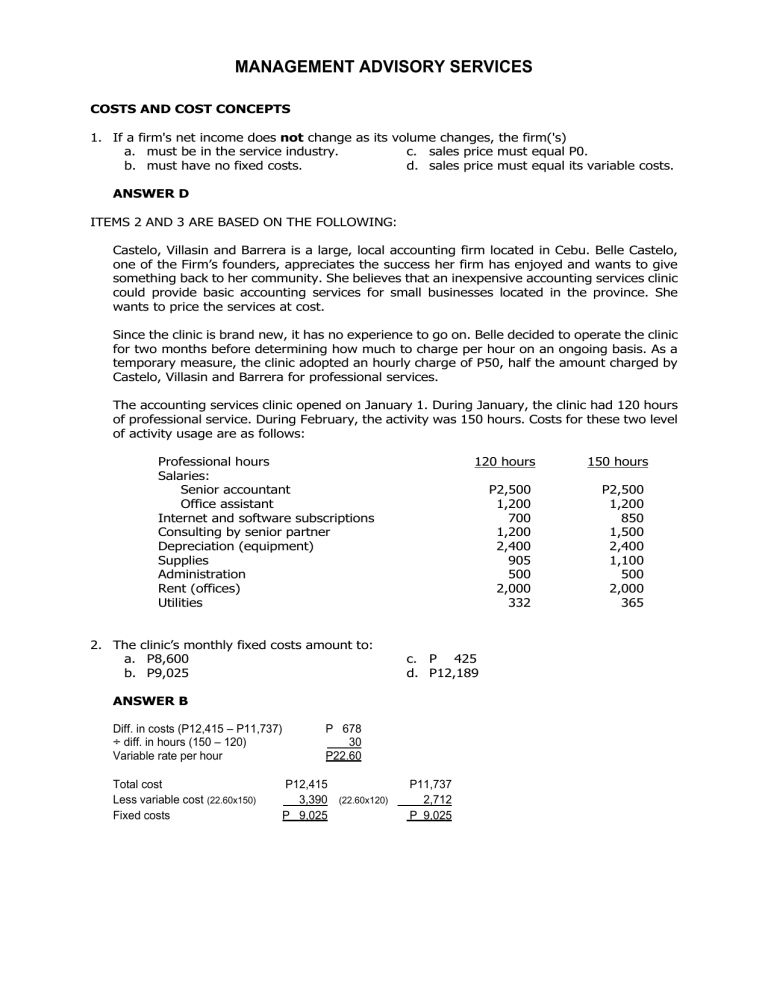

Add all the fixed costs to get the total fixed cost. The total fixed costs of a business are all the costs that do not change no matter the number of units produced.

Cost structure refers to the types and relative proportions of fixed and variable costs that a business incurs.

. Labor is treated as a variable cost since producing a greater quantity of a good or service typically requires more workers or more work hours. 24 df between -206 and 206. 10 df between -223 and 223.

10 df between -181 and 181. As a concrete example of fixed and variable costs consider the barber. Cost structure is used as a tool to determine prices if you are using a cost-based pricing strategy as well as to highlight areas in.

Variable costs on the other hand are incurred in the act of producingthe more you produce the greater the variable cost. 24 df outside the interval from -280 to 280. Variable costs would also include raw materials.

24 df between -280 and 280. The concept can be defined in smaller units such as by product service product line customer division or geographic region. 934 Given a variable that has a t distribution with the specified degrees of freedom what percentage of the time will its value fall in the indicated region.

For example a piece of machinery that has a capacity of producing 10000 units per hour already has its capacity set and will have the same cost even if you are not using all the capacity available.

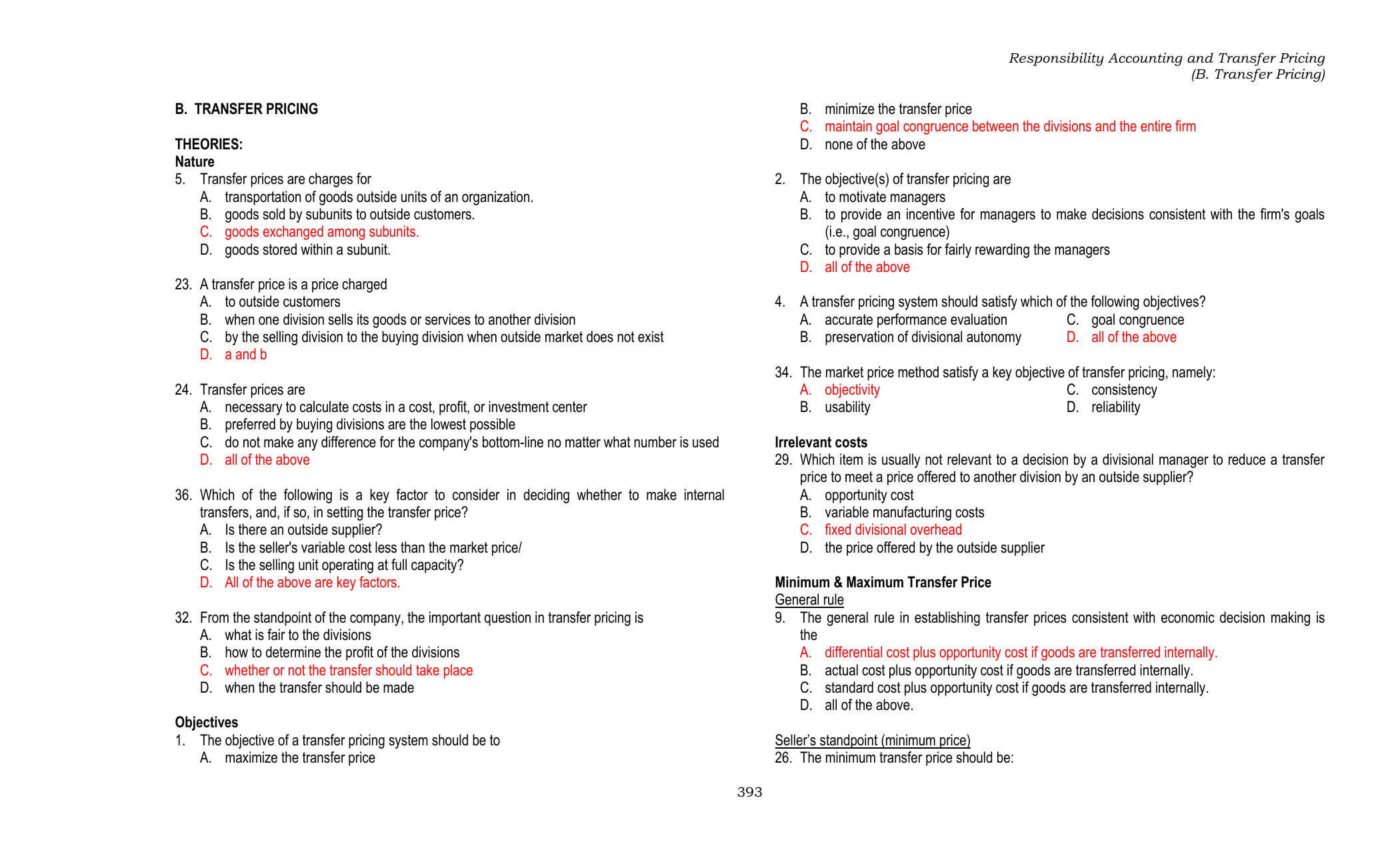

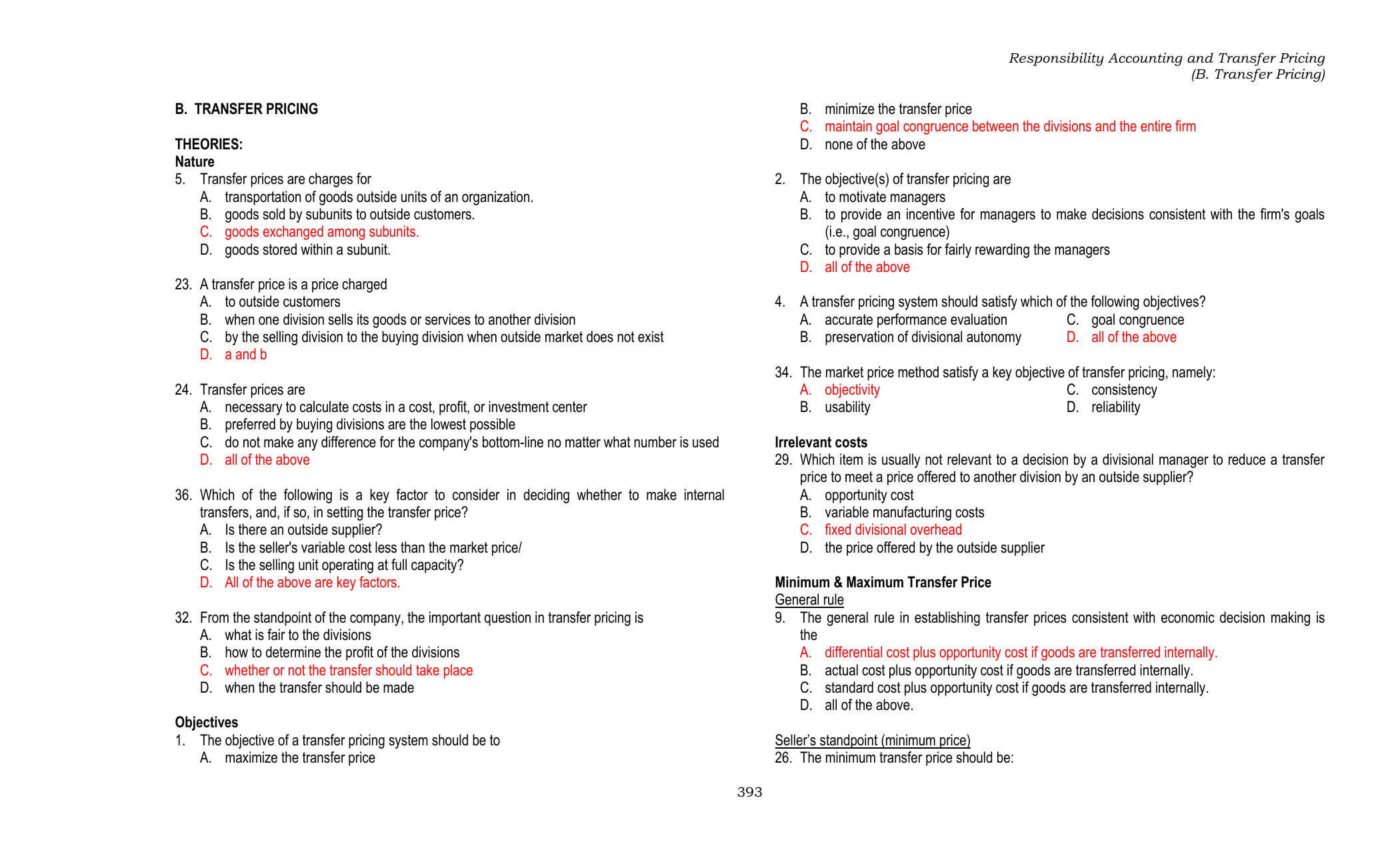

08 X07 B Responsibility Accounting And Tp Transfer Pricing

Evaluate And Determine Whether To Keep Or Discontinue A Segment Or Product Principles Of Accounting Volume 2 Managerial Accounting

No comments for "Division a Has Variable Manufacturing Costs of"

Post a Comment